Disclaimer: The following are very brief summaries of critical steps in the home buying and selling process. They are meant to provide a basic understanding. I recommend that you have thorough conversations with your Realtor, attorney, and any other parties to make sure that they have a full understanding of your situation and all of the factors involved. One thing I have learned in 22+ years of real estate – every home and every deal are different. Be certain you have all of the information needed in order to make the decision that’s best for you!

THE HOME BUYING PROCESS

Loan pre-approval: Use a local lender or reputable on-line lender. Pre-approval is not a loan approval and is based only on what you tell the lender. This generally includes income, debt/monthly payments. This gives you (the buyer) the estimated costs for the loan, an estimated monthly payment, and the total loan amount for which you qualify. That information, combined with additional funds you have, will determine the price range of the home you can consider. You don’t have to “spend” everything. I generally recommend that you spend no more than 33% of your gross income on your housing costs. This gives you some funds to put toward home repairs or remodeling projects.

Loan approval: Loan approval process begins once you have a ratified contract. Your lender will require tax returns, pay stubs, list of debts/payments, etc. and ask for very detailed financial information. Once all this information has been processed by the lender and the appraisal on the home you are purchasing has been received, you will be notified as to whether or not your loan has been approved. Keep in mind that final approval or “loan commitment” comes from the underwriter and not your loan officer. They will do one final review the day of closing so DO NOT take out any new loans, make any large purchases, or change jobs at this time – all of these things can impact your final loan approval.

Appraisal: All lenders will require an appraisal of your home as part of the loan approval process. Your contract will specify what happens if the appraisal is below the contracted price of the home. If the appraisal is below, you typically don’t have to purchase the home. Your Realtor can try to work it out with the seller’s agent. Possible options may include the seller coming down in price to the appraised value or both the seller and buyer agree to a price somewhere in between. Keep in mind, if you agree to pay more than appraised price, the lender will require you to pay that difference in cash.

Finding a Realtor: There are many ways to find a Realtor – you can search online, ask friends for a referral, or some other manner. The bottom line is to find a full-time agent that focuses on real estate and does not have another job or distractions. Make sure that you are comfortable talking with them and that you trust their advice. This is one of the largest purchases you’ll ever make and you want the transaction to go as smoothly as possible.

Inspections: Your contract should be contingent on a home inspection. Depending on the market conditions you have options to have a full inspection and ask for repairs or you can have an inspection that is for informational purposes only (basically telling the seller you will not ask for any repairs). In either of these situations, you should make sure that you can walk away from your contract based on the results of the inspection. You are making a huge investment in a home that you’ve seen for maybe an hour. Having an expert spend 3-4 hours in that home (with you) helping you to understand what is right, wrong, and where potential repairs may be needed will help you to understand the overall condition of the home.

Finding an inspector: Your Realtor should be able to provide 2-3 very good local inspectors that have worked in your community for years.

Homeowners Associations: If the home you are buying is located in a community that has a mandatory HOA (Homeowners Association) you must receive the HOA disclosure package from the seller within a certain timeframe as outlined in your contract. This package outlines very important information such as: monthly fees, one-time fees at time of purchase, any legal issues impacting the owners, notes from meetings, financial statements, and rules and regulations. Once you have received this package of information you typically have 3 days to review it and withdraw from the contract if the HOA rules don’t fit your specific needs. (For example: you work for an HVAC company and have a company van. The HOA rules may prohibit you from parking your work van in your driveway or street)

Earnest Money Deposit This is a “good faith deposit” and the amount is set by the seller. The contract in Virginia clearly states how a buyer can lose this deposit (lists specific defaults of buyer). Otherwise, if the deal falls apart a buyer would typically receive their earnest money deposit back. If the deal closes, the earnest money deposit is credited toward closing costs or downpayment. Your Realtor can help you understand fully how this can impact your offer. Timing is critical and you should have your earnest money deposit ready when writing an offer.

The term “as-is”, “where-is”: This is very complicated as most sellers will state “selling the home as-is, where-is; seller will not do repairs”. What does this mean? What about repairs to a well, septic, or termites? Does the seller just mean inspection repairs? Make sure your Realtor knows what repairs the seller is or is not willing to make. Make certain that information is included in the contract so ALL parties agree to the terms and conditions.

The Purchase Contract: Read your contract – even if you have a very experienced Realtor. Ask for a copy of the blank contract when you meet and read it before you see your first home. Be sure to ask them any questions you may have and don’t assume the Realtor knows what you know or exactly what your needs are. Communication is key and they should be able to answer your questions making both of you feel better about the home buying process.

THE HOME SELLING PROCESS

Understanding the Local Real Estate Market: One of the biggest mistakes I see sellers making is applying other market dynamics to Williamsburg. We are not Miami, Los Angeles, Richmond – we are Williamsburg, VA. Your Realtor should be able to provide an overview of the local real estate market and share information about recent home sales for your area/neighborhood.

Home Value: We all want the top dollar for the home we love and have lived in for many years. It is natural. But markets move all the time. In 2021-22 we had a huge seller’s market with almost every home receiving multiple offers. List prices were rising and homes were selling rapidly. That isn’t the case in today’s real estate market. Interest rates are up, buyers are more selective about paying a premium, and price ranges are still seeing full price/above list price offers.

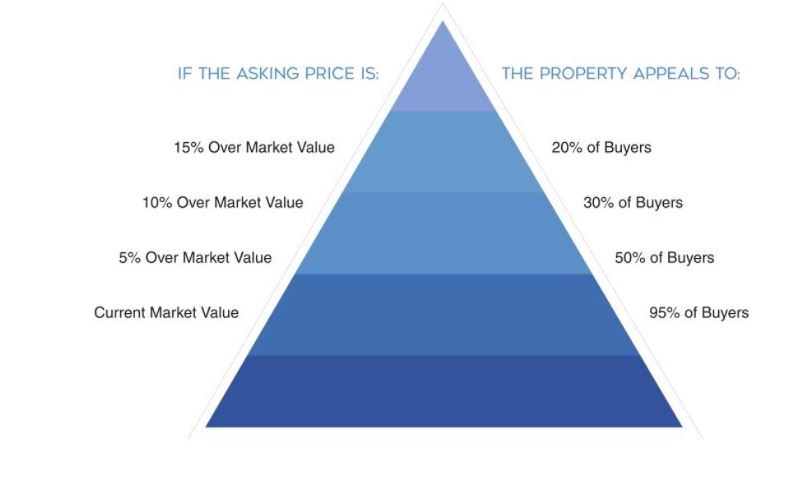

Setting the List Price: Work with a listing agent to help set the price of your home. A good listing agent knows this is the most important step in marketing a home. They should be able to tell you the list price, sold price, and days to sell of comparable homes in your neighborhood or comparable homes in similar neighborhoods. You should also look at what has gone under contract and importantly what is for sale (this is your competition). You need to be honest when establishing your pricing. Look at your home like you are a buyer again and compare it to the comparable homes your agent has provided.

What is the Best Time to Sell your Home? I hear people say “I don’t want to sell in November, December, January or February.” The fact is that houses sell and people move every day of the year. Do more homes sell in the spring and summer? Sure, they do. (Statistically only about 10-15% more). If you wait until spring/summer to sell your home, you are potentially facing stiffer competition with more people waiting until then to sell as well. The right time to sell your home is when you are fully committed and ready to move (or have already moved).

Choosing an Agent: There are many agents to choose from. The bottom line is that you want someone you are comfortable with and you can trust. You may want to consider the agent that represented you when you purchased your home, or an agent that lives in your neighborhood who has had good success, and you may even consider someone who was recommended by friends or family. Look at the homes they have sold, their client testimonials, and their bio on their website to help you decide if they are a good fit for you.

The Listing Agreement: The most important thing you need to know about the listing agreement is that it IS a legally binding contract. If you have questions that you feel are not being answered, then speak with an attorney. The listing agreement can be for any period of time, for any price, and for any commission. Do not take this agreement lightly. Make sure your listing agent goes over each paragraph with you and that you understand it. There is space in most listing agreements to write in any terms that aren’t covered – e.g. How to cancel the agreement and how dual agency is being handled…amongst others.

Getting Your Home Market Ready – This question almost always comes up when I talk with people about selling their home. The answer is complicated and is different for every owner. There are some home owners who have kept their home up to date with regard to décor, improvements, and maintenance. There are also home owners who have lived in their home for 20, 30, 40 years and have maintained it, but have not changed the décor or made improvements.

The first question I ask any homeowner – Do you have an annual inspection for your crawl space? Crawl space!? That’s right and that is where most real estate deals fall apart. I think it is safe to say the majority of homeowners do not have an annual inspection of their crawl space (costs maybe $150). They only find out about termites, wood rot, mildew, standing water, or mold at a home inspection. By the time all of this is discovered, the buyer is gone and the owner needs to fix all the issues. To keep this from happening, I recommend that you find a good local termite and moisture company, have them do an inspection, and get under an annual contract. This is number 1, 2, and 3 on what you “need” to do!

Most buyers want to make sure nothing major is staring them in the face after paying a premium for their home. Please make sure you also have annual maintenance on your HVAC systems or other mechanical elements in your home.

If you have had your home as a rental or are an out of town/state owner then I would suggest a home inspection prior to listing your home. You will then know what needs fixed and what is working properly.

Renovations prior to selling – I am not a fan of making major renovations to sell your home. I can’t find one renovation that returns more than you spent. There are some in the 90%-95% range. So why would you spend $100 to raise your listing price by $90?

The most important thing, in my opinion, is get your home uncluttered, cleaned, and painted (where needed). Get the outside yard and shrubs spruced up, put down some fresh mulch. This is by far the biggest bang for your buck. You want your home to show up spectacularly on-line, buyers to make appointments to see it, and fall in love once they are inside.

If I can answer any real estate related questions you may have, just call/text (757) 254-6678 or email tevans@cbwilliamsburg.com.

Ted Evans, Associate Broker